Get the free andhra bank kyc form

Show details

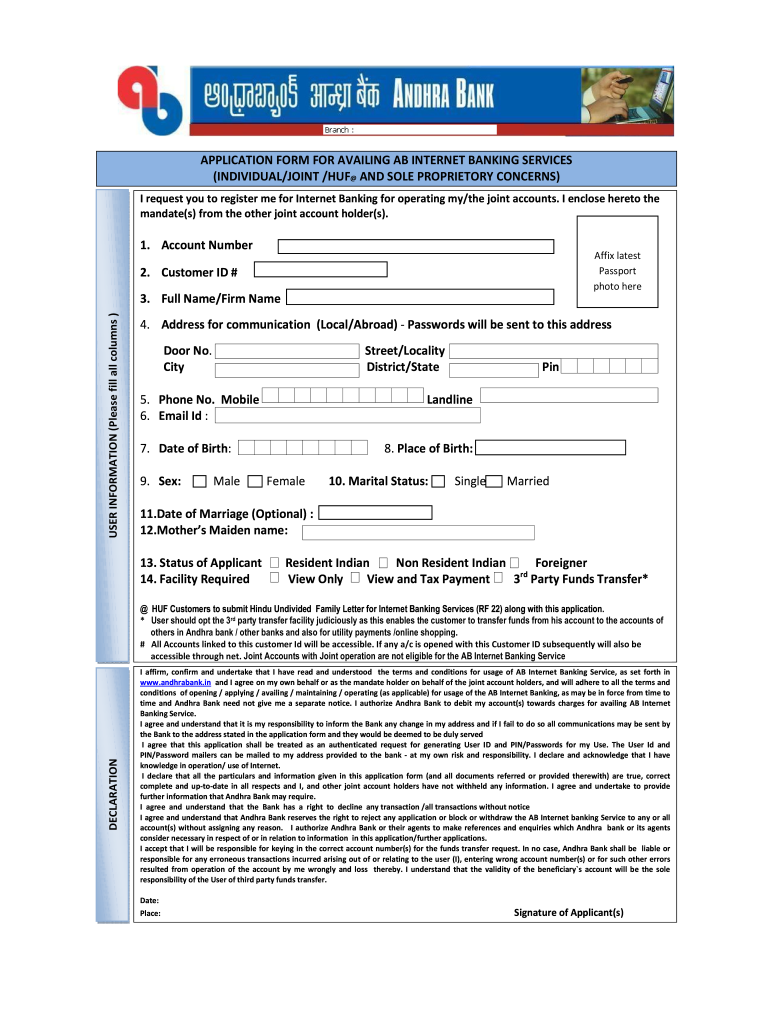

Signature of Branch Head Receipt of Acknowledgement from the applicant Acknowledgement-cum-User ID Intimation Slip Individual Internet Account received on ACKNOWLEDGEMENT Cut along and Handover to customer Date Signature of the applicant -------------------------------------------------------------------------TEAR HERE ----------------------------------------------------------------------------------------Andhra Bank Individual Internet accounts Welcome to our AB-INFINET Internet Banking...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your andhra bank kyc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your andhra bank kyc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing andhra bank kyc form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit andhra bank kyc update online form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

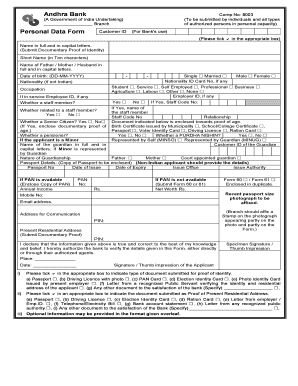

How to fill out andhra bank kyc form

How to fill out a banking application:

01

Gather all necessary documentation such as identification, proof of address, and income statements.

02

Research different banking institutions and select the one that best suits your needs.

03

Start the application process either online, over the phone, or in-person at a branch.

04

Provide accurate and complete information, including personal details, employment information, and financial history.

05

Make sure to carefully read and understand all terms and conditions before signing any agreements or providing consent.

06

Double-check all entered information for accuracy before submitting the application.

07

Follow up with the bank if necessary to provide any additional requested documents or information.

08

Await a response from the bank regarding the status of your application, which can take several days to weeks.

Who needs a banking application:

01

Individuals who require a secure and convenient way to manage their finances.

02

Business owners who need access to banking services like business accounts, loans, and merchant services.

03

People who want to monitor their spending, track their transactions, and plan their budgets effectively.

04

Individuals who need to make online payments, transfer funds, or access other digital banking features.

05

Anyone who wants to apply for credit cards, loans, or other financial products offered by banks.

06

People who have savings goals and want to open savings accounts or investment accounts.

07

Those who travel frequently and require access to banking services from anywhere in the world.

08

Individuals who need to deposit and withdraw cash or cheques.

Video instructions and help with filling out and completing andhra bank kyc form

Instructions and Help about andhra bank online form

Fill andhra bank account opening form pdf : Try Risk Free

People Also Ask about andhra bank kyc form

How do I get my KYC form?

Where can I download KYC form?

What is a KYC form?

What is KYC form online?

How do I complete KYC online?

Can we submit KYC form online?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is banking application?

A banking application is a software program that allows users to manage their banking accounts, including making payments, transferring funds, and checking their account balances. It can also be used to apply for loans, open new accounts, and set up automatic payments. Some banking applications also include additional features, such as budgeting tools, financial calculators, and investment advice.

When is the deadline to file banking application in 2023?

The exact deadline for filing banking applications in 2023 will depend on the specific bank or financial institution. Generally, banks and financial institutions will accept applications until the end of the year or until the end of the quarter in which the application is filed.

Who is required to file banking application?

It depends on the specific context. Generally, individuals or businesses looking to establish a new bank or banking institution are required to file a banking application with the relevant regulatory authority. Additionally, existing financial institutions may also need to file applications for various purposes, such as obtaining a banking license, seeking regulatory approval for mergers or acquisitions, or applying for permits to offer new banking services or products.

How to fill out banking application?

To fill out a banking application, follow these steps:

1. Start by downloading or obtaining a copy of the application form either online or from the bank branch.

2. Read the instructions and requirements carefully to ensure you understand each section before proceeding.

3. Begin filling out the personal information section, which includes your name, address, phone number, and email address. Provide accurate and up-to-date information.

4. Move on to the account details section, where you'll specify the type of account you want to open (savings, current, etc.) and the account features you require (debit card, online banking, etc.).

5. If applying for a joint account, fill in the details of the second account holder, including their personal information and identification details.

6. You might be required to provide your employment information, such as the name of your employer, position, and monthly income. Be sure to provide accurate details in this section.

7. Next, specify the initial deposit amount you plan to make to open the account.

8. Proceed to provide identification information, such as your Social Security number or national identification number, date of birth, and nationality.

9. If applicable, provide information about any previous banking relationships you have had, such as other accounts or loans.

10. Additional sections may ask for details about your financial history, assets, liabilities, and references. Fill in these sections accurately and honestly.

11. Review the form to ensure all sections are filled correctly, and no information is missing or incomplete.

12. If required, attach any necessary supporting documents, such as photocopies of identification, proof of address, or income verification.

13. Sign and date the application form where indicated. Some applications may require multiple signatures if it is a joint account or requires other account holders.

14. Make a copy of the completed application for your records.

15. Submit the application form along with any supporting documents either online or at the bank branch as per their instructions.

Always ensure the accuracy and truthfulness of the information provided on a banking application to avoid any potential issues or delays in the account opening process.

What is the purpose of banking application?

The purpose of a banking application is to provide customers with a convenient and secure platform to access and manage their banking accounts and perform various financial transactions. The application allows users to view their account balance, transfer funds between accounts, pay bills, track transactions, apply for loans, view and download statements, manage investments, and perform other banking activities. It offers a user-friendly interface that allows customers to access banking services anytime and anywhere, enhancing their overall banking experience and providing convenience and flexibility. Additionally, banking applications may incorporate features such as fraud detection, customer support, account notifications, and budgeting tools to further assist customers in managing their finances effectively.

What information must be reported on banking application?

When a person fills out a banking application, there is certain information that is typically requested and must be reported. The specific requirements may vary based on the bank and the jurisdiction, but the following information is commonly required:

1. Personal Information: Name, date of birth, gender, nationality, and current address.

2. Contact Details: Phone number, email address, and alternate contact information.

3. Identification Documents: A valid government-issued identification document, such as a passport, driver's license, or ID card.

4. Social Security Number or National Identification Number: This is essential for identity verification and compliance with anti-money laundering regulations.

5. Employment and Income Details: Details of employment, including employer's name, address, and contact information. Information about income, such as salary, investments, and other sources of income.

6. Previous Banking Relationships: Details of any existing or past banking relationships, including the names of banks, account numbers, and reasons for closing accounts if applicable.

7. Financial Information: Details about assets, liabilities, and net worth. This can include information about properties owned, loans, credit card balances, and outstanding debts.

8. Purpose of Account: The intended use and purpose of opening the account, such as personal savings, checking, investment, or business banking.

9. Source of Funds: Information about the source of funds that will be deposited into the account, especially if significant amounts of money are involved.

10. Beneficiary Information: If applicable, the details of any beneficiaries or joint account holders, including their personal information, identification documents, and relationship to the applicant.

11. Signatures: The applicant's signature and date to acknowledge the authenticity and accuracy of the information provided.

It's important to note that banks may have additional requirements depending on their internal policies, regulatory obligations, and the type of account being opened. Additionally, some information may be subject to verification and additional documentation may be requested by the bank during the application process.

What is the penalty for the late filing of banking application?

The penalty for late filing of a banking application can vary depending on the specific country and the regulations in place. Generally, the penalty can range from monetary fines to the rejection of the application. In some cases, it may also result in delays in processing or additional administrative requirements. It is essential to review the specific rules and regulations of the relevant regulatory authority to understand the potential penalties for late filing of a banking application.

How can I send andhra bank kyc form to be eSigned by others?

Once you are ready to share your andhra bank kyc update online form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get banking application?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific andhra bank kyc update and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out andhra bank application form online using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign andhra bank application form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your andhra bank kyc form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Banking Application is not the form you're looking for?Search for another form here.

Keywords relevant to andhra bank kyc online form

Related to bank services application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.